Green Resilience Hubs: An Energy and Financial Model

This report provides a comprehensive analysis of the feasibility of designing and financing a Green Resilience Hub (GRH). GRHs are physical facilities equipped with clean energy technologies and strategically located to offer vital services to local communities before, during, and after emergencies such as natural disasters.

The primary goal of this report is to offer insights to developers and investors interested in constructing resilient infrastructure that can provide essential community services–even during disruptions to the electrical grid. As a group of master’s students at the Yale School of the Environment, we have identified significant potential for GRHs to support communities in emergencies while also providing sustainable revenue streams during non-emergency periods.

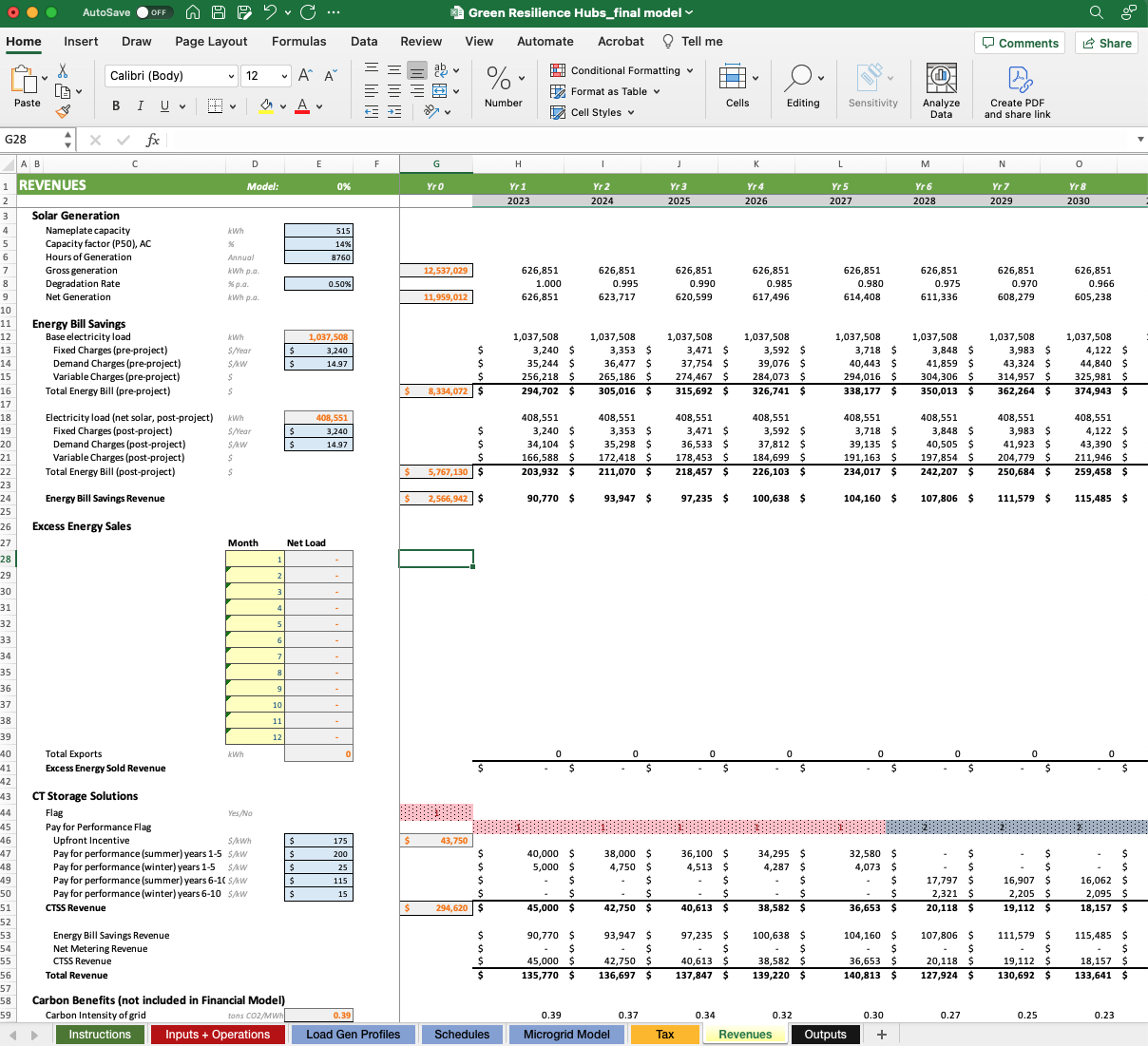

In this report, we define the essential steps involved in designing a GRH. These steps include involving the community, determining what electrical loads will be backed up, sizing a battery, choosing a technology mix, and creating operational strategies. Furthermore, we offer potential operating and business models for GRHs. We then examine financing options, including an outline of relevant costs and revenues and an analysis of federal tax incentives. Finally, we present the key inputs and takeaways from the energy and financial model we developed using Microsoft Excel.

Our energy and financial model, published with this report, is built using the Connecticut Green Bank campus as a case study. It is designed to be easily adapted to analyze other projects. The model uses hourly energy demand and generation data as well as battery dispatch logic to calculate bill savings, revenues, and level of disaster resilience for the project. We included incentives provided by both the Inflation Reduction Act (“IRA”) and the state of Connecticut. Our case study results demonstrate that GRHs become highly bankable in communities that qualify for the IRA "bonus" credits and thus offer an enormous economic opportunity for both communities and developers.

The provisions in the IRA boost tax credits for low-income areas, tribal land, brownfield redevelopment sites, and communities located near energy-extractive industries. These bonuses significantly expand the opportunity for financially viable energy resilience projects in these traditionally under-resourced communities. The case study and analysis presented herein aim to be a valuable resource for developers, investors, and interested communities striving to enhance collective resilience in the face of natural disasters. We hope this report will foster the development of these vital projects across the United States.

Published October 2023

Read and Download the Report

Watch the webinar

The report authors, Sarah Geldhill, Maggie Thompson and Max Wasser are hosted a webinar to talk through this report and answer questions. Watch the recording: