Financing and Deploying Clean Energy Certificate Program

Core Courses Content

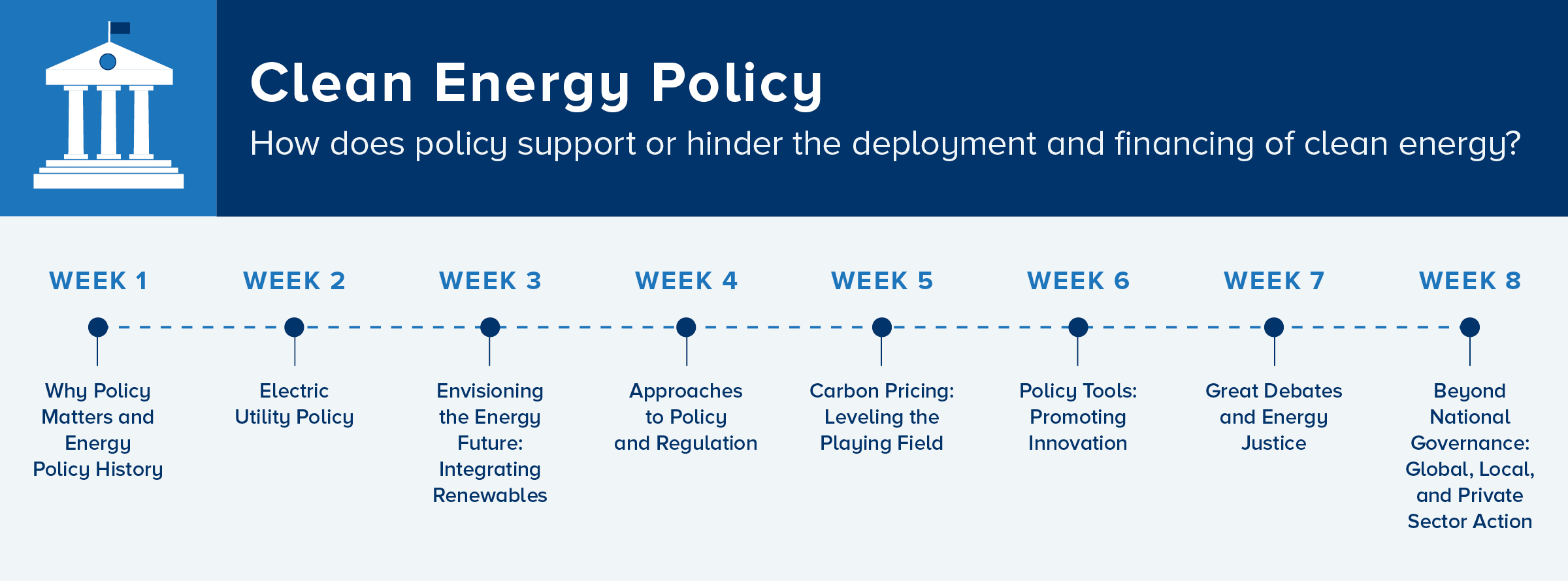

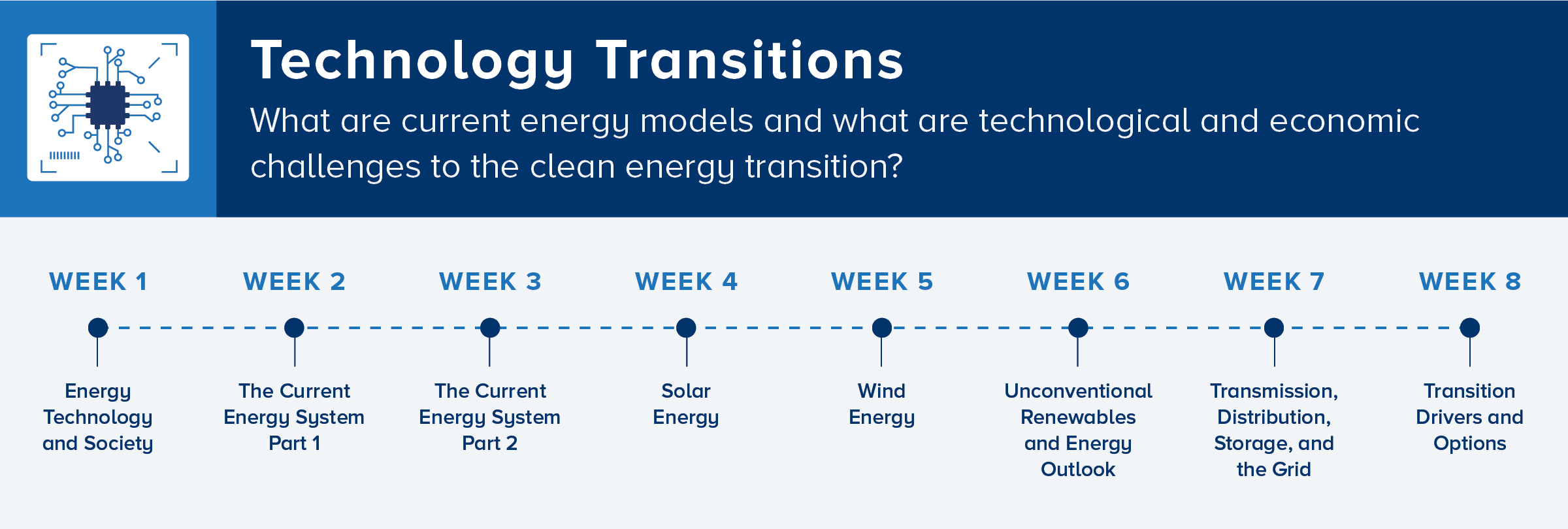

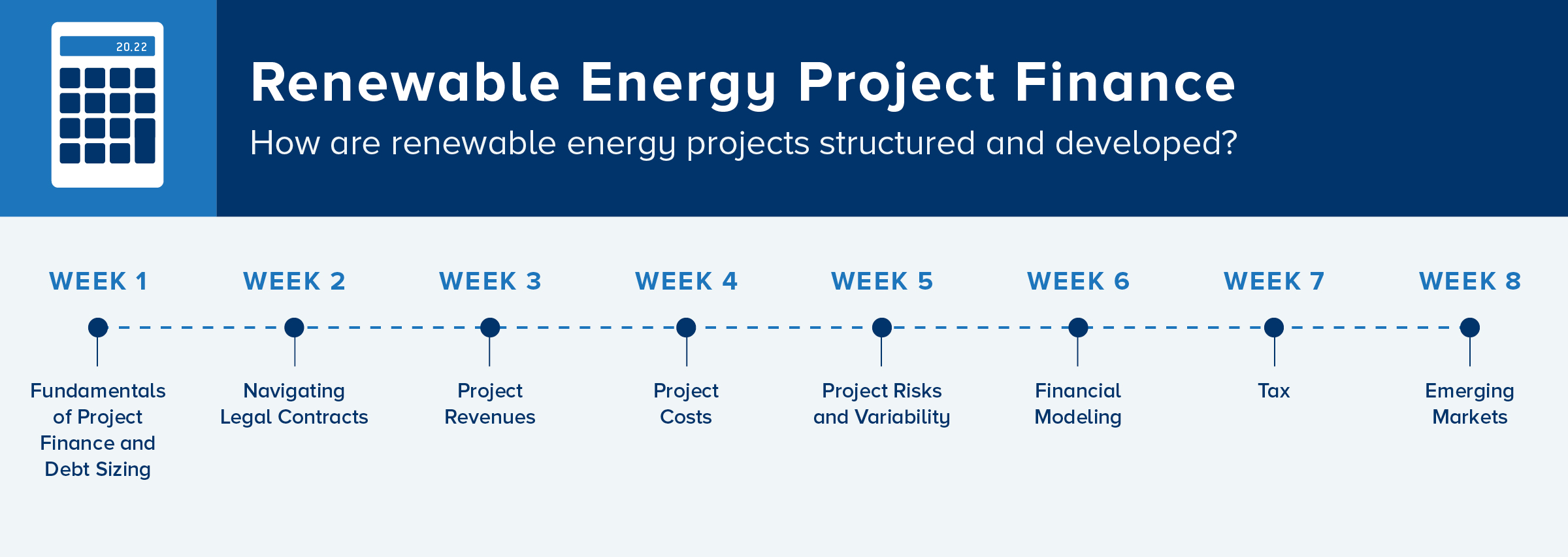

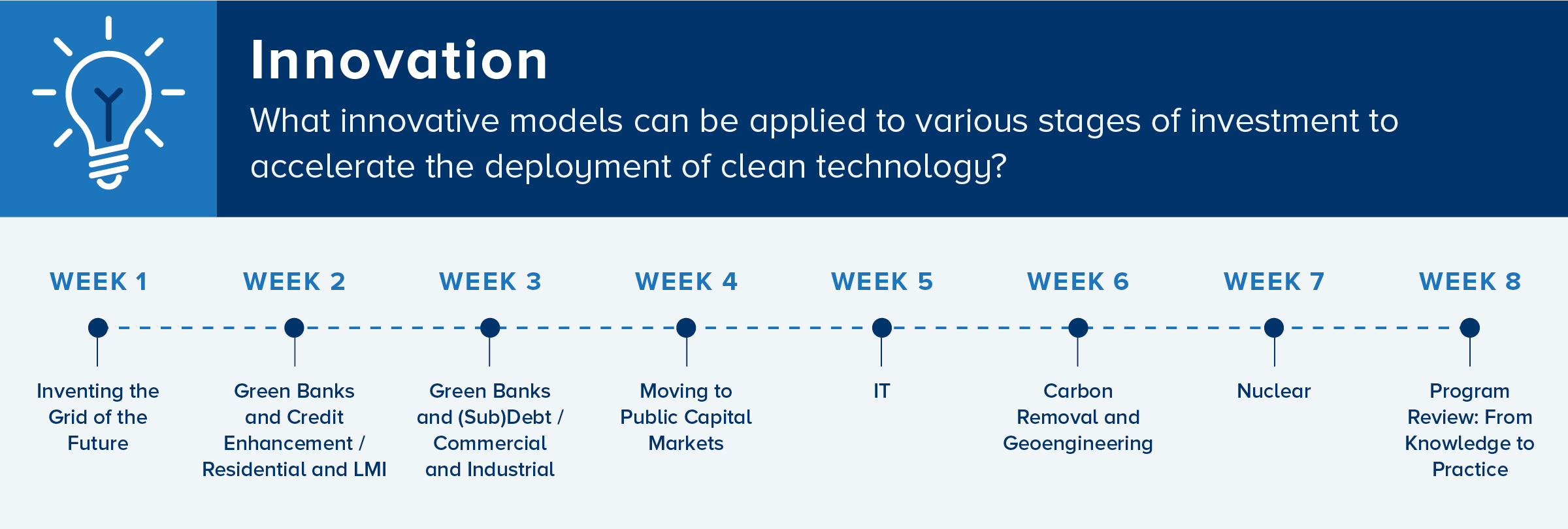

The Core Courses of the Financing and Deploying Clean Energy program run sequentially, from August through May. They include Clean Energy Policy, Technology Transitions, Renewable Energy Project Finance, and Innovation.

A broad description of the curriculum is available below and week by week themes and learning objectives for the core courses are available for download.

First Core Course

First Core Course

This course is co-led by Dr. Robert J. Klee and Dan Esty. Dr. Klee is a Yale School of the Environment Lecturer, Lecturer in Law at Yale Law School, and former Commissioner of the Connecticut Department of Energy and Environmental Protection. Dan Esty is a Hillhouse Professor of Environmental Law and Policy at the Yale Law School and the Yale School of the Environment and also a former Commissioner of the Connecticut Department of Energy and Environmental Protection.

This course will teach you to think creatively about institutional design. Because energy is a highly regulated market, policy plays a large role in shaping the transition to a clean energy economy. At its best, effective policy promotes a sustainable energy future by encouraging innovation and leveling the playing field for all fuels to compete fairly. Poorly designed policy, even if well-intentioned, can have the opposite result. You will explore how policy is made and what makes it successful by examining the current regulatory framework, energy policy history, and case studies.

What participants are saying about this course:

"It has given me a much better understanding of how the work I do fits into the overall picture. It's also given me a new lens to think about regulatory or legislative changes that might drive volume in financing programs."

Second Core Course

This course is led by Senior Research Scientist at Yale, Michael Oristaglio.

The transition from the entrenched fossil fuel economy is fraught with obstacles that require deep systems knowledge to navigate. Moving along a pathway to a low carbon future means understanding which technologies are available, how they work, and what their limitations are. In this course, you will examine technological transitions, current and incoming energy technologies, the structure of the utility grid and how it will fare with integrating new technologies and increasing demand, as well as the socio-behavioral insights that influence buildings, transport, materials, and energy storage.

What participants are saying about this course:

"Working in solar development, I now have a real understanding of the chemical and physical processes through which solar panels generate electricity. I am more conversant on storage, transmission, the grid, and AC/DC power. The course has improved my everyday understanding of the projects I'm supporting."

Third Core Course

This course is led by Yale School of the Environment Lecturer and private equity investor Daniel Gross.

This course will delve into the foundational principles of project finance from both the perspective of the renewable energy investor as well as the developer. In this course, you will take a closer look at the challenges inherent to financing renewable energy projects whose cashflows stem from the sale of intermittent power through power purchase agreements and learn to analyze risks, structure a transaction, read legal documentation derived from real projects, and build financial models.

What participants are saying about this course:

"Phenomenal instruction, breaking down complex/market/industry topics into understandable terms and scenarios, and with excellent real-life what-ifs to help with applying what we've learned. Truly impressed by the level of teaching in this course! Thank you again! It’s clear Dan Gross has a passion for this work, and in sharing/imparting his knowledge."

Fourth Core Course

This course is led by Yale School of Management Lecturer and Chair of the New York State Energy Research and Development Authority Board Richard Kauffman.

In this course, you will examine what innovative models can be pursued to accelerate the clean energy transition and hear from a range of experts about innovation in the fields of policy, technology, and finance. Despite the meteoric rise of some renewable technologies like solar, financial markets have been relatively slow to react to the call for a clean economy transition. This cautious response is in part due to a lack of standardized commercial arrangements, insufficient performance data, misperceptions of risk, and lack of access to secondary capital markets, which together increase the cost of capital.

What participants are saying about this course:

"This course has given me enough understanding to apply for very different positions than I've had in past, and the confidence that I can learn and succeed in whatever pathway of finance, policy, or innovative thinking or I choose to pursue. It's also given me the renewed optimism that following such a path requires."