Filling the Funnel: Climate-focused Investment Strategies in SPAC Land

The Yale Center for Business and the Environment (“CBEY”) is looking for a team of students to participate in an independent study (equivalent to a full-credit course) in partnership with Climate Real Impact Solutions I Acquisition Corporation (“CRIS”), a Special-purpose Acquisition Company (“SPAC”).

Overview

SPACs have found favor amongst climate-focused companies as they (a) give companies the opportunity to provide public investors with forward projections on innovative business models that are profitable but have limited access to capital, and (b) allow said companies to obtain permanent financing via public equity capital markets.

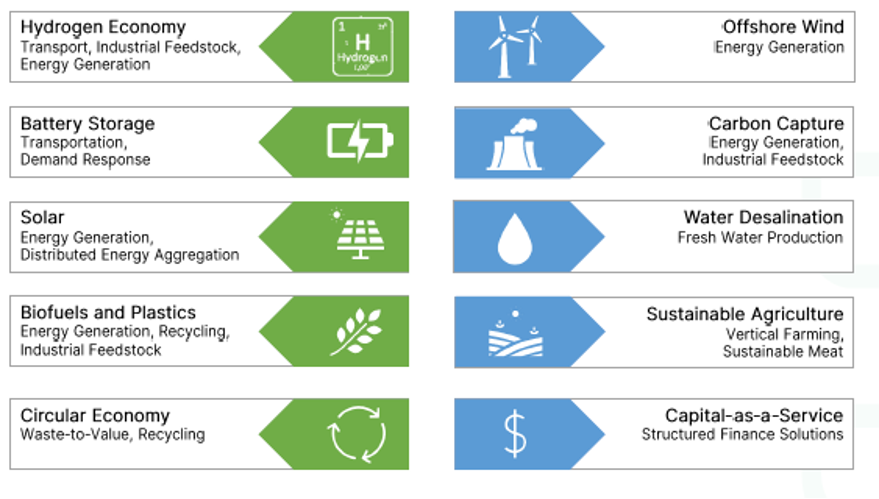

CRIS was incorporated in late 2020 in order to identify and effect a business combination via a reverse merger with a best-in-class, climate-focused company. Students in this independent study will conduct research on new, innovative sectors with the potential for transformative positive impact. These focus areas include the following:

Issue Summary

Decarbonization of the global economy, and adoption of more sustainable means of consumption, represent one of this generation’s greatest economic, social, and moral imperatives. These prevailing tailwinds, coupled with the magnitude of the task in hand, conspire to present an investment opportunity worth trillions of dollars over the coming decades.

In particular, CRIS, targets investment in three key subsector verticals, and summarizes its focus with the mantra of: (1) Winning the (Green) Home, (2) winning the (Green) Office, and (3) winning the (Green) Roads. These verticals represent a collective $3.7 trillion total addressable market, and with the potential offset 7.4 billion tonnes of CO2 amongst other positive impacts per annum.

The CRIS team is led by seasoned industry veterans with deep industry experience at the intersection of climate change and capitalism at firms including NRG, Credit Suisse, Goldman Sachs, and General Electric. CRIS seeks to identify investment opportunities in companies led by world-class management teams, with not only have the potential to become market leaders, but who also share our deep conviction and commitment to transforming the home, office, and road.

The goal of this independent study is for students to work in consultation with members of the CRIS team and its partners and advisor to identify areas within these subsector verticals that present attractive investment opportunities for a SPAC such as CRIS. Students will be given the opportunity to develop and present an investment thesis to leadership at CRIS, whilst learning about the arcane world of clean energy SPAC investing from industry veterans.

Deliverables

This research will include a number of deliverables, including (i) a research report that summarizes the potential investment opportunity in the sector for CRIS, and (ii) a summary presentation (the “IC Memo”) wherein the student serves as an exponent for investment in the sector of choice, and (iii) a summary presentation (the “Short-seller Note”) wherein the student argues for not investing in said sector, or even for betting against the sector.

The research report will include an analysis of potential market opportunities to provide goods and services across the value chain for subsectors, an analysis of the total addressable market or revenue opportunity for such subsectors, a competitive analysis between companies within the sector, and against the prevailing conventional ‘dirty’ goods and services, and valuation analyses (where applicable). Appendix I: Outline provides an illustrative table of potential contents for such a report.

The presentations will synthesize the work in the research report into a concise, and cogent narrative articulating reasons for (and against) investment in the sector, including identifying and valuing individual companies of interest. The students must first present and receive approval from the Committee, comprised of Kristofer Holz and Amir Chireh Mehr, Vice Presidents at CRIS, Stuart DeCew, Executive Director at CBEY, and a few others, after which point they will be given the opportunity to present to CRIS leadership members, which may include officers of the company and members of its Board of Directors.

Stages of Work

- Participate in an ‘Introduction-to-SPACs’ session with CRIS advisors, to understand how SPACs invest, as viewed through the lens of CRIS IPOs;

- Conduct a first-pass analysis of value chain segments within the chosen sector, including reviewing equity research and consulting reports, and other sources of information;

- Develop qualitative and quantitative arguments to support a thematic hypothesis for investment within a specific area within the value chain of the subsector;

- Participate in a Case Study of the EVGo acquisition by Climate Change Crisis Real Impact I (NYSE: CLII) to better understand the business combination process;

- Synthesize the research work into a 10-15 page first draft;

- Draft first version of IC Memo, and Short-seller Letter;

- Present the IC Memo, Short-seller Note, and research report to the Committee;

- Make any final revisions to the deliverables;

- Present to CRIS Leadership.

Staff and Advisors

- CBEY: Stuart DeCew; Todd Cort, Ben Soltoff

- CRIS: Kristofer Holz, Vice President; Amir Chireh Mehr, Vice President

- Project Team: 2-to-3 CBEY Students (each working 10 hours per week)

- External partners and advisors of CRIS

How to Apply

To apply for this independent study, please send your resume and a statement of interest no longer than half a page to Ben Soltoff (ben.soltoff@yale.edu) with a CC to Amir Chireh Mehr (ac.mehr@climaterealimpactsolutions.com).