Advice for Yale Entrepreneurs

This year we asked our judges, mentors and experts to weigh in on some advice as you prepare your application and continue to pursue your startup venture.

"Make sure what you’re building is a need to have, not a nice to have, for your customers. Build a painkiller, not a vitamin.” — Jake Saper, Principal at Emergence Capital

Yale Landscape Lab

"Remind yourself that you're probably deep in. You need someone who is hearing about your idea for the first time to fully follow your narrative from identified problem to proposed solution. And at the same time, the story you tell needs to be captivating.” — Justin Freiberg, Director of the Yale Landscape Lab

Yale Carbon Charge

“Make a realistic plan for how your team will support yourselves for the next year as you work on your venture. Be honest with yourself about how much money you will need in order to devote yourself to your venture, and be prepared to answer questions about the plan. The judges are betting on you and your ability to follow through, so show them your diligence, realism and candor. These are foundations of trust.”— Casey Pickett, Director of the Yale Carbon Charge

Social Entrepreneurship, Wesleyan University

“Don’t just tell me about the problem you want to solve, your innovative idea and why it’s better or different than what’s out there already, and your team’s credentials. Tell me why you care about this. Tell me why you are passionate about this work and will stop at nothing to see it through. Your story matters!” — Makaela Kingsley, Director, Patricelli Center for Social Entrepreneurship, Wesleyan University

and President of CURE Innovations

"Work to ensure that your innovation is presented with passion as a story about how it uniquely serves a need." — Susan Froshauer, President and CEO of CURE and President of CURE Innovations

at Connecticut Innovations

A truly successful business need not result in a multi-billion dollar IPO. Similarly, relying on venture capital to fund your business is not always necessary nor recommended. Make sure your vision and your business model are well aligned with your capital sources. Solve a real problem that consumers/enterprises will eagerly pay for, surround yourself with people smarter than you, and have passion for what you are building. — Douglas Roth, Director of Investments at Connecticut Innovations

“Start a financial model sooner than later. Even if just a crude one put together over an afternoon, it’ll help you see key assumptions and understand the resources you’ll need for those hockey-stick revenues.” — Trey Kellett, MD at Offset Capital Group

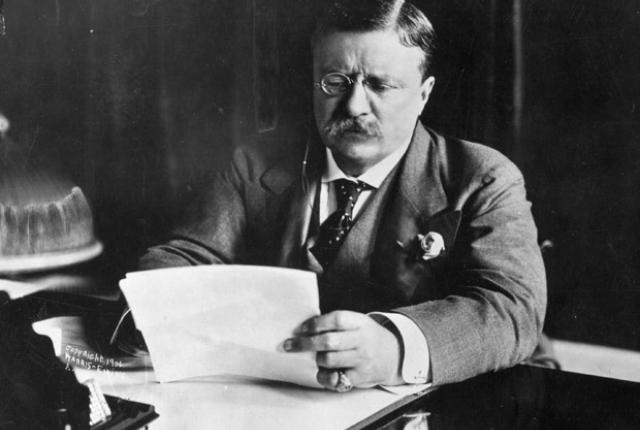

“It is not the critic who counts; not the [person] who points out how the strong [man or woman] stumbles, or where the doer of deeds could have done them better.The credit belongs to the [man or woman] who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends [themself] in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if [he or she] fails, at least fails while daring greatly,” — Theodore Roosevelt, USA President (offered by Kyle Jensen, Associate Dean and Shanna and Eric Bass '05 Director of Entrepreneurship & Senior Lecturer at Yale School of Management)